We start onboarding by assessing your economic and personal profile to ensure our services align with your needs and goals. By evaluating factors like your loss tolerance, risk appetites, experience and knowledge, and objectives and needs, we tailor our offerings to help you make informed decisions and navigate the markets responsibly. This process ensures you get access to the products tailored to your situation, goals, and risk appetites.

Why We Run This Assessment

We want to provide you with the most relevant services based on four key areas:

- Loss Tolerance – Your financial stability and how you typically handle potential losses.

- Risk Appetite – Your comfort level with risk, from conservative approaches to more dynamic strategies.

- Experience & Knowledge – How familiar you are with various investment products, market behavior, and related concepts.

- Objectives & Needs – Your primary goals, which may include short-term gains, long-term investments, or general financial learning.

By carefully assessing these areas, we can tailor an offer that aligns with your profile, helping you make informed and weighted decisions. Whatever offer you get, please keep in mind that no investment product guarantees return, and all involve risk, especially CFDs (Contracts for Difference), which are among the most complex and high-risk instruments.

Our Range of Offers

Our offerings fall into three main categories:

1. Educational Only

- We may decide, based on the answers, that any financial products we have do not align with your profile.

- Gives you access to high-quality learning materials — our educational suite provides extensive resources designed to support investors and traders of all experience levels.

2. Educational + Investment

- Designed for investors aiming for sustainable, balanced growth.

- Combines ongoing education with access to investment products.

3. Educational + Investment + CFDs

- Designed for investors ready to engage with higher-risk products and willing to trade or invest with us.

- CFDs are complex financial instruments that can amplify both gains and losses. As such, they require a deeper understanding of market dynamics and a higher risk tolerance.

Each product offer has minimum criteria based primarily on its complexity and risk level. If our assessment indicates that your profile doesn’t match the requirements for certain products (especially CFDs), it means we’re acting in your best interest to protect you from taking on unsuitable risks.

Why Some Instruments May Not Be Available

Not all instruments are shown to every client. Availability depends on the results of the Assessment— a short test designed to evaluate your knowledge, experience, and risk profile. This ensures that the products you see are aligned with your current goals and ability to manage risk.

If a product category isn’t available, it means that based on your profile it may not be suitable at this time. This isn’t a restriction but a safeguard, helping you avoid unnecessary exposure to risks that may not fit your current experience level.

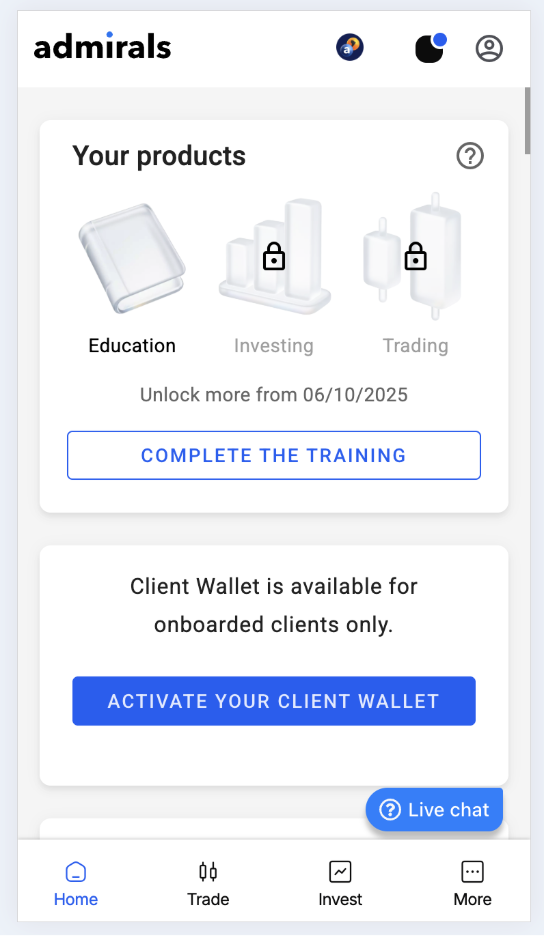

Your current offer is always visible on the Dashboard Home page in the Product Offer Widget.

Example:

From Dashboard, you can see available categories and guidance on how to retake the assessment if you’d like to update your profile.

What If You Want a Different Offer?

If you're considering a different (or more advanced) offer, we encourage you to return to our product offer configuration assessment, which will help ensure that you receive the products most aligned with your profile. You might find helpful:

- Enhancing Your Knowledge: Use our educational resources to deepen your understanding of market trends, investing and trading strategies, and risk management.

- Revisiting Your Objectives and Needs: Clarify your financial goals, decide what kind of market exposure you’re looking for.

- Assessing Your Risk Appetite: Clarify and provide an accurate answer about your risk/reward preferences, considering the risk levels associated with more complex products.

Stay Flexible as Your Needs Evolve

Markets shift, personal circumstances change, and your circumstances and goals might evolve over time. If you ever feel that your situation, risk appetites, or objectives have changed, you’re welcome to retake our assessment. This will help us continue offering products that align with your updated profile.

We have a mandatory cooldown period before you can retake the TMA test. Once this period has passed, you will be able to retake the test and unlock additional products. The exact date when you can do this is displayed in the widget in your Dashboard: Unlock more from [date].

Exemple:

If you have any questions or need more information, do not hesitate to contact us.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article